Calculating your monthly loan payments doesn’t have to be complicated. Whether you’re planning to buy a home, purchase a car, or take a personal loan, understanding your EMI (Equated Monthly Installment) is crucial for effective financial planning. Fortunately, with our Free EMI Calculator Tool, you can calculate your monthly loan payments instantly with complete accuracy. This guide will not only help you understand how EMI works but also walk you through using the calculator and the benefits of using such a tool in your financial planning.

What is an EMI?

EMI stands for Equated Monthly Installment. It is the fixed payment amount you pay every month to a lender until your loan is fully repaid. EMIs are widely used for home loans, car loans, personal loans, and other types of financing. Each EMI includes two components: principal and interest.

-

Principal: The actual amount you borrowed from the lender.

-

Interest: The cost charged by the lender for providing you the loan.

Paying EMIs regularly ensures that your loan is repaid systematically over the agreed period, making it easier to manage your finances.

Why Knowing Your EMI is Important

Many people apply for loans without fully understanding their EMIs, leading to financial stress and budgeting issues. Calculating your EMI before taking a loan can help you:

-

Plan Your Budget: Know how much of your monthly income will go toward loan repayment.

-

Avoid Overborrowing: Prevent taking a loan amount that may strain your finances.

-

Compare Loans: Evaluate different loan options to choose the most affordable one.

-

Track Interest Payments: Understand how much interest you are paying over time.

Using an EMI calculator online simplifies this entire process and saves you from manual calculations or relying solely on bank statements.

How EMI is Calculated

The EMI for a loan is calculated using a standard formula:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n - 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

-

P = Loan amount (principal)

-

r = Monthly interest rate (annual interest rate ÷ 12 ÷ 100)

-

n = Number of monthly installments

While this formula may seem complex, using an online loan EMI calculator makes it effortless. You simply enter the loan amount, interest rate, and loan tenure, and the tool provides your exact monthly payment.

Benefits of Using a Free EMI Calculator Tool

Our Free EMI Calculator Tool offers multiple benefits for users like students, salaried professionals, loan seekers, and financial planners. Here are the key advantages:

1. Instant Calculation

You don’t need to spend hours performing manual calculations. Our calculator gives you your monthly EMI instantly.

2. Accurate Results

With precise algorithms, the calculator provides 100% accurate EMI calculations, factoring in principal, interest rate, and loan tenure.

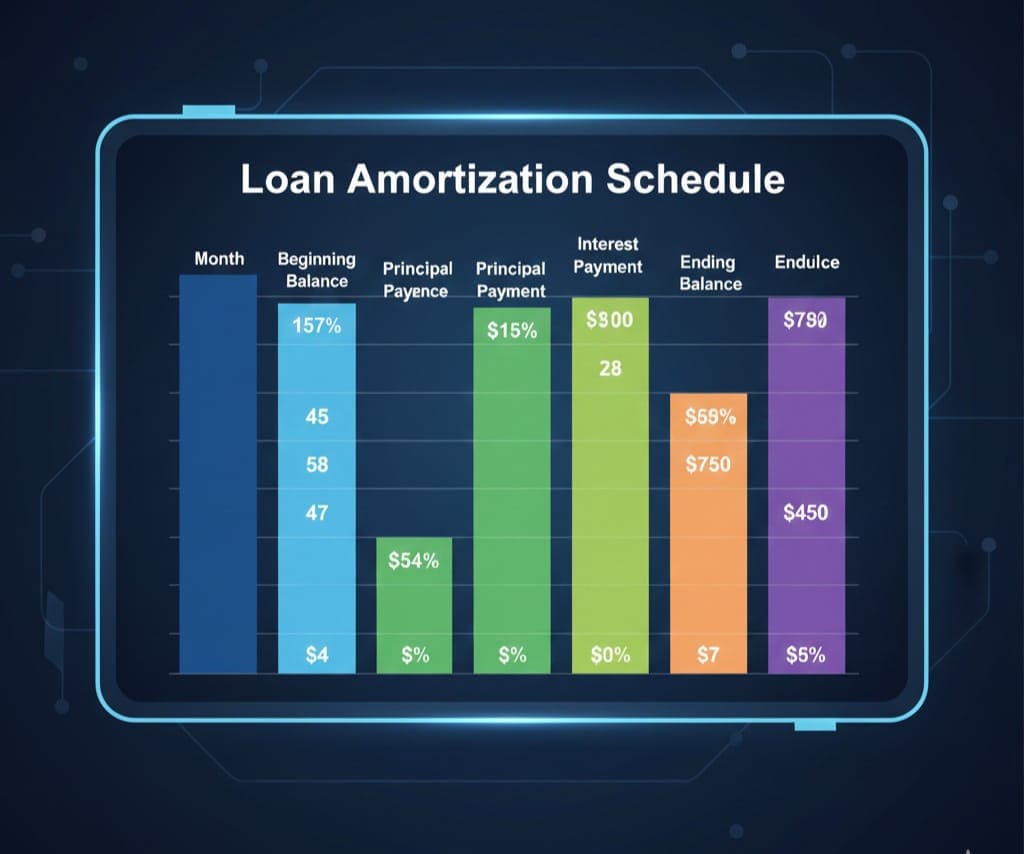

3. Amortization Schedule

The tool also generates a detailed amortization schedule, showing the breakup of principal and interest for every month of your loan tenure. This helps you track your repayment progress clearly.

4. Compare Different Loan Options

You can test multiple scenarios by changing loan amounts, interest rates, or tenures to determine the most suitable EMI for your financial situation.

5. Financial Planning Made Easy

With a clear understanding of your monthly payments, you can plan your budget better and make informed decisions about borrowing and spending.

Types of Loans You Can Calculate with an EMI Calculator

EMI calculators can handle various types of loans. Here’s how they can be used for different purposes:

Home Loans

Home loans are usually long-term loans with interest rates that vary between lenders. Using an EMI calculator can help you estimate your monthly obligations and decide on the best loan tenure.

Car Loans

Car loans often have shorter tenures compared to home loans, but interest rates can vary. Calculating your EMI beforehand ensures you can comfortably manage your monthly car payments.

Personal Loans

Personal loans are usually unsecured, meaning they don’t require collateral. An EMI calculator helps you determine if the repayment amount fits within your budget, reducing the risk of financial strain.

Business Loans

For entrepreneurs and small business owners, EMI calculators help assess monthly obligations and manage cash flow effectively.

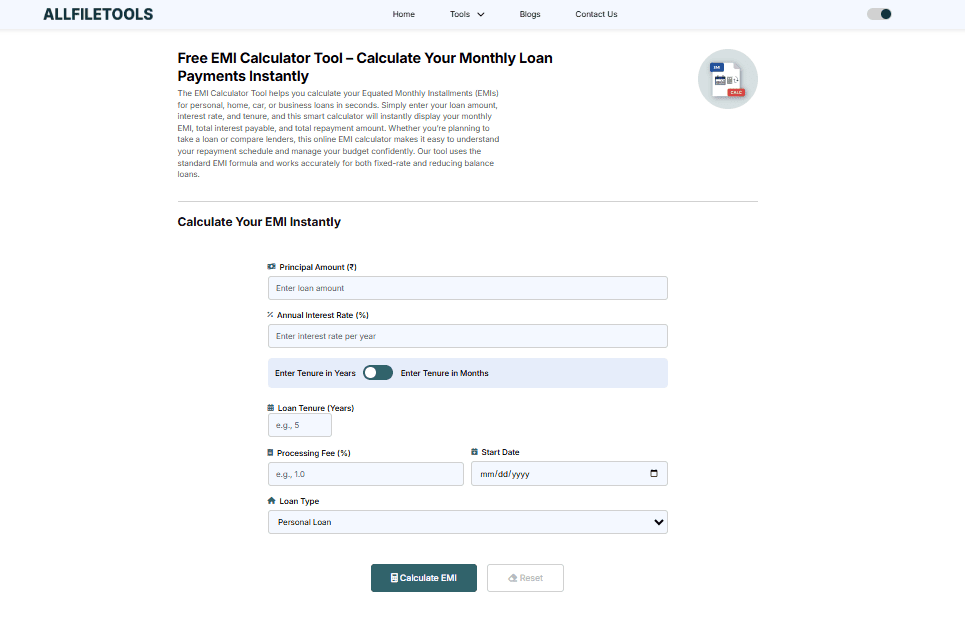

How to Use the Free EMI Calculator Tool

Using our Free EMI Calculator Tool is extremely simple. Here’s a step-by-step guide:

-

Enter Loan Amount: Input the total loan you wish to borrow.

-

Enter Interest Rate: Provide the annual interest rate applicable to your loan.

-

Enter Loan Tenure: Specify the loan duration in months or years.

-

Click Calculate: Press the calculate button to instantly get your EMI.

-

Review Amortization Schedule: Check the detailed principal and interest breakup for each month.

The tool is fully online and free, meaning you can use it anytime without any registration or downloads.

Key Features of Our EMI Calculator

Our EMI calculator is designed to be user-friendly and highly functional. Here are some notable features:

-

Instant EMI Calculation

-

Principal & Interest Breakdown

-

Amortization Chart

-

Flexible Input for Tenure & Rates

-

Prepayment Calculation Option

-

Works for All Types of Loans (Home, Car, Personal, Business)

These features make it an indispensable tool for anyone planning to borrow or manage loans efficiently.

Common Misconceptions About EMI

Many borrowers have misconceptions regarding EMIs. Here are a few clarifications:

-

EMI Amount Never Changes

Many assume that EMIs fluctuate with interest rate changes. For fixed-rate loans, your EMI remains constant throughout the tenure. -

Shorter Tenure Always Means Less Interest

While shorter tenures reduce total interest, they increase monthly payments. An EMI calculator helps balance this trade-off. -

Prepayment is Always Beneficial

Prepaying reduces interest but may have penalties. Use our calculator to simulate different prepayment scenarios.

EMI Calculator vs Manual Calculation

Manually calculating EMIs can be time-consuming and error-prone. Let’s compare:

| Feature | Manual Calculation | EMI Calculator Tool |

|---|---|---|

| Accuracy | May have errors | 100% accurate |

| Speed | Time-consuming | Instant |

| Ease of Use | Requires math knowledge | User-friendly |

| Scenario Testing | Hard to test multiple options | Quick comparison |

| Amortization Schedule | Difficult to generate | Automatically generated |

Clearly, using an online EMI calculator saves time, improves accuracy, and helps in better financial planning.

Tips for Using an EMI Calculator Effectively

-

Know Your Budget: Before entering values, assess your monthly income and expenses.

-

Compare Multiple Lenders: Use the tool to simulate different interest rates from various banks or fintech platforms.

-

Adjust Loan Tenure: See how changing the tenure affects your monthly payment.

-

Use Prepayment Options Wisely: Evaluate if prepayment is feasible using the calculator.

-

Plan for Emergencies: Don’t set your EMI at the maximum you can afford; leave room for unforeseen expenses.

Case Study: How the EMI Calculator Helps Users

Example Scenario

Rahul, a salaried professional, wants to buy a car worth $15,000.

-

Loan Amount: $15,000

-

Interest Rate: 10% per annum

-

Loan Tenure: 3 years

By using our Free EMI Calculator Tool, Rahul instantly discovers his monthly EMI is approximately $484. He also gets a detailed schedule showing how much goes toward principal and interest each month.

This helps him plan his budget effectively, avoid overborrowing, and stay financially secure.

Why Students and Young Professionals Should Use an EMI Calculator

Students and early-career professionals often take loans for education or buying their first car. Calculating EMIs in advance helps them:

-

Avoid financial stress

-

Plan monthly budgets

-

Understand interest burden

-

Make informed borrowing decisions

Our free tool makes this process quick and easy, even for those new to loans.

Storytelling: A Financial Planner’s Perspective

Sonal, a financial planner, advises her clients to always calculate EMIs before taking a loan. She shares:

"Many people commit to loans without knowing the exact monthly obligations. With our EMI calculator, clients can visualize their payment schedule, interest contribution, and total outflow. It’s a simple step that prevents financial pitfalls."

This shows that using an EMI calculator is not just convenient, but also a smart financial habit.

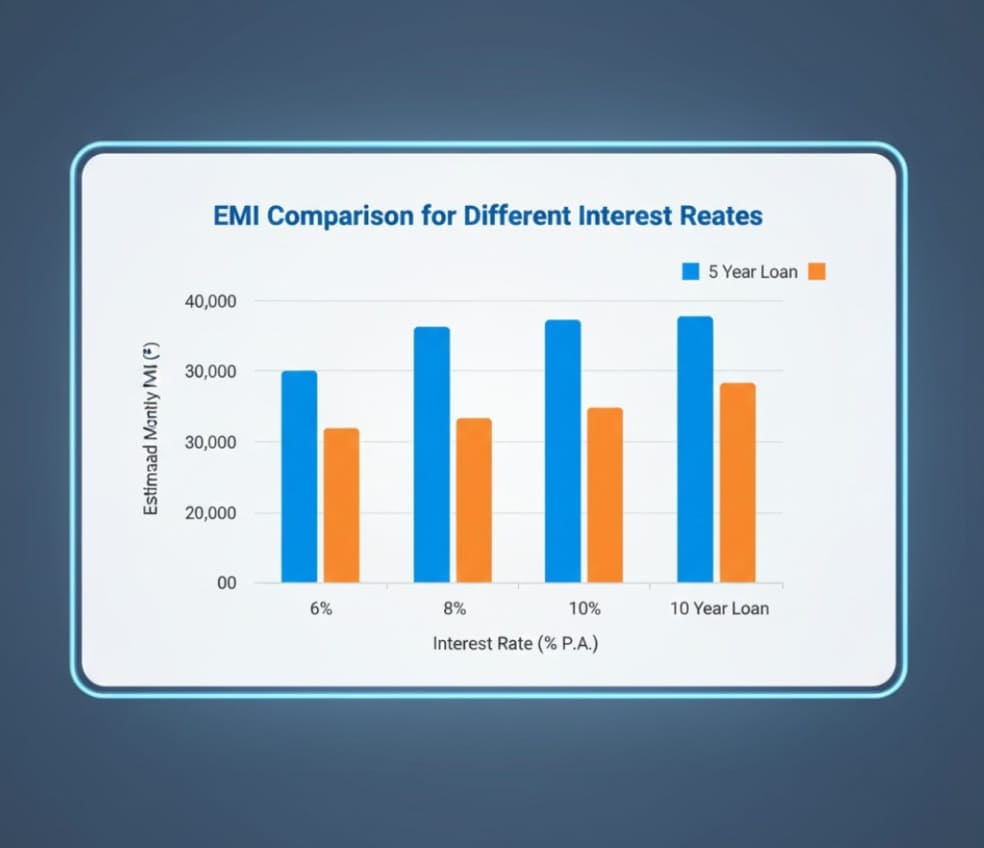

Understanding EMI and Interest Rates

Interest rates are the cost of borrowing. A higher interest rate increases your EMI, while a lower rate reduces it. Using the calculator, you can test scenarios:

-

Scenario 1: 8% interest rate → lower EMI

-

Scenario 2: 12% interest rate → higher EMI

This analysis helps you choose the best loan and repayment plan.

Conclusion

Using a Free EMI Calculator Tool is essential for anyone planning a loan. It not only simplifies complex calculations but also helps you make informed financial decisions. Whether you are a student, salaried professional, or financial planner, knowing your EMI in advance empowers you to budget effectively, avoid financial stress, and achieve your financial goals with confidence.

For instant and accurate calculations, try our Free EMI Calculator Tool now and take the first step toward smarter loan management.

Frequently Asked Questions (FAQs)

-

What is an EMI?

EMI stands for Equated Monthly Installment, which is a fixed monthly payment you make to repay a loan, including principal and interest. -

Can I calculate EMI for any loan type?

Yes, our EMI calculator supports home loans, car loans, personal loans, and business loans. -

Is this EMI calculator free to use?

Absolutely! Our tool is 100% free, with no registration or download required. -

Does the EMI change over time?

For fixed-rate loans, EMI remains constant. For floating-rate loans, EMIs may vary with interest rate changes. -

Can I see the principal and interest breakup?

Yes, our tool provides a detailed amortization schedule showing principal and interest for each month. -

How accurate is the EMI calculation?

The calculator uses precise formulas to provide accurate results instantly. -

Can I simulate prepayment scenarios?

Yes, you can adjust loan amounts and tenure to see the impact of prepayments on your EMI and total interest.

Leave a Comment

No comments yet. Be the first to comment!